“Stimulation”, not the Cure for Inflation!

While the government wants to keep us gullible, Henry Hazlitt teaches us the real cure for inflation. Published 11/11/22

There is one characteristic common in Americans that may ensure their doom in the fight against the current inflation they are facing: their own willful ignorance. While it has been stressed by many (including this aurhor) that economic shutdowns imposed by the Federal and State governments, along with historic mass money printing by the Federal Reserve during the CoronaVirus hysteria were the main catalysts for the inflation we have today, another driving factor for this current inflation has been largely ignored: the stimulus checks.

These checks became popular during the CoronaVirus hysteria when President Trump signed the COVID relief bill back in December 2020, starting the trend of and setting the tone for more spending, taxing and printing in the name of economic “relief.”

On these checks, Jeff Deist writes: “These pumped more than $5 trillion directly into the economy in the form of payments to government, payments to households, unemployment benefits, employer payroll loans, cash subsides to airlines and countless other industries, and a host of grab-bag earmarks which had nothing to do with COVID.”

While many people praised these stimulus checks and saw them as the greatest gift ever given to them by their government, what these checks actually ended up causing was, you guessed it, more inflation!

Robert Aro writes: “The thought of receiving ‘free money’ from the government may initially sound appealing. But eventually the money mirage stops and society discovers these government giveaway programs carry grave consequences such as currency debasement, and therefore, more poverty.”

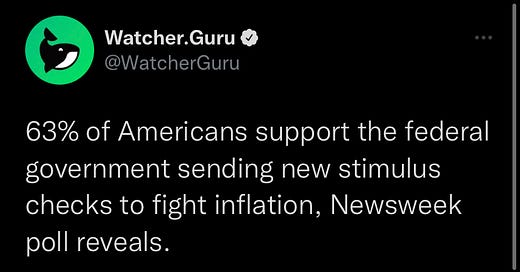

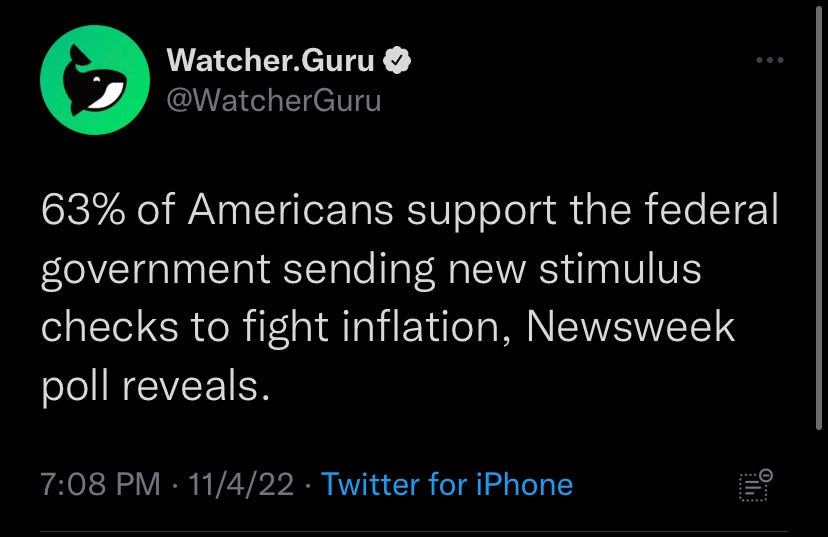

Americans have discovered these grave consequences, however they have not the slightest idea about their consequences. Afterall, if they did, then they may realize that inflation is the expansion of the money supply, then they could at least think twice before being in favor of something like this:

So, what is the way to go if you are looking to fight against inflation and actually win? Well, it is all about reversing the trend set by our Federal government of spending, taxing and printing money. Economist Henry Hazlitt spells it all perfectly in a chapter of his 1960 book What You Should Know about Inflation appropriately titled “The Cure For Inflation.”

On spending and taxing, Hazlitt writes: “It is next to impossible to avoid inflation with a continuing heavy deficit. That deficit is almost certain to be financed by inflationary means—i.e., by directly or indirectly printing more money. Huge government expenditures are not in themselves inflationary—provided they are made wholly out of tax receipts, or out of borrowing paid for wholly out of real savings. But the difficulties in either of these methods of payment, once expenditures have passed a certain point, are so great that there is almost inevitably a resort to the printing press.

Moreover, although huge expenditures wholly met out of huge taxes are not necessarily inflationary, they inevitably reduce and disrupt production, and undermine any free enterprise system. The remedy for huge governmental expenditures is therefore not equally huge taxes, but a halt to reckless spending.”

So, as logic follows, of course huge deficit spending by the government necessitates endless money printing by their central bank. They have to keep belly of the beast full somehow. Of course, the Biden administration knows this. In September, the Committe for a Responsible Federal Budget published this article, which states: “We estimate the Biden Administration has enacted policies through legislation and executive actions that will add more than $4.8 trillion to deficits between 2021 and 2031, or nearly $2.5 trillion when excluding the effects of the American Rescue Plan. This is on top of the trillions of dollars we were projected to borrow before President Biden took office…Of the non-interest deficit increases, about $3 trillion is from legislation – including a net $1.6 trillion passed on a partisan basis and $1.4 trillion passed on a bipartisan basis. Another $1.1 trillion comes from executive actions…In total, the Biden Administration has added $4.8 trillion to deficits over the 2021-2031 period as a result of legislative and executive actions. With inflation at a 40-year high and debt headed for record levels, substantial deficit reduction will be needed to put the country on a sustainable fiscal course.”

As for taxes, it was expected that Biden would be as tax-happy as the rest of the clowns that were once President. Though it must be remembered that the most sinister tax of all is inflation. It is a hidden tax on the poor for what government does and plans on doing.

This just goes to show that the government literally does not care about us average, everyday Americans. They will do whatever they can to keep and expand their power, even if it screws us over in the long run while driving society closer to collapse. However, dwelling on this sad reality will not bring us any closer to our goals in the fight against inflation.

So, let us see what Hazlitt has to say about money printing: “On the monetary side, the Treasury and the Federal Reserve System must stop creating artificially cheap money; i.e., they must stop arbitrarily holding down interest rates. The Federal Reserve must not return to the former policy of buying at par the government’s own bonds. When interest rates are held artificially low, they encourage an increase in borrowing. This leads to an increase in the money and credit supply. The process works both ways—for it is necessary to increase the money and credit supply in order to keep interest rates artificially low. That is why a ‘cheap money’ policy and a government-bond-support policy are simply two ways of describing the same thing. When the Federal Reserve Banks bought the government’s 2½ per cent bonds, say, at par, they held down the basic long-term interest rate to 2½ per cent. And they paid for these bonds, in effect, by printing more money. This is what is known as ‘monetizing’ the public debt. Inflation goes on as long as this goes on.”

As said before, it is almost impossible for this to happen by government decree. The Federal Reserve’s endless money printing finances their empire. Even if the dollar is in decline and said empire is crumbling, they will keep themselves under the delusion that they are still number one, and they will act like it while making sure that we and the rest of the world stay fooled by the same delusion.

To wrap up this chapter, Hazlitt simply reminds us of how terrible inflation is: “Inflation, to sum up, is the increase in the volume of money and bank credit in relation to the volume of goods. It is harmful because it depreciates the value of the monetary unit, raises everybody’s cost of living, imposes what is in effect a tax on the poorest (without exemptions) at as high a rate as the tax on the richest, wipes out the value of past savings, discourages future savings, redistributes wealth and income wantonly, encourages and rewards speculation and gambling at the expense of thrift and work, undermines confidence in the justice of a free enterprise system, and corrupts public and private morals.”

While there is a great chance the government will never reverse the trend and a set a tone opposite of the one that gives us endless spending, taxing and printing of our money for their evil ventures, there are ways we can help ourselves during this inflationary madness. This author has recently written on how to protect ourselves from inflation by adopting a strategy of financial defense, and living a lifestyle of self-sustainability. This time it will be stressed that Americans should not be so naive about what the government is actually doing when they claim to be so kind and generous with their actions, as they do with the stimulus checks. It will also be stressed that Americans should educate themselves more on real economics, like that professed by the Austrian School, and then start to pay attention more to the economic consequences they have to suffer along with their fellow citizens because of their own government’s measures and manipulative malpractice.